Gone are the days where companies solely focused on making profits for their shareholders. Companies are progressively shifting their attention to all of the stakeholders from their owners, customers and suppliers to society as a whole.

In the midst of a global pandemic and in anticipation of its repercussions on economic activity, companies must show that they care about their community and the environment more than ever. While the notion of Corporate Social Responsibility (CSR) – of companies acknowledging their impact on society and being held accountable for it- is nothing new, the increasing integration of Environmental, Social and corporate Governance (ESG) frameworks by firms marks a turning point for businesses, financial reporting and investment. As a volunteer for the ESG Foundation, I hope to raise awareness of the importance of ESG, to learn about the ways in which specific firms are working towards their ESG goals and actively contribute to finding innovative ways for them to engage with their stakeholders.

Is ESG simply a new trend or does it actually differ from CSR? The notion of ESG is grounded in that of CSR, but it takes it one step further. The definition of CSR can vary from one company to another, referring to anything ranging from volunteering to efforts at reducing carbon emissions. Thus, CSR does not allow for cross-sector or even intra-industry comparisons. On the other hand, by providing various criteria, ESG frameworks are far more apt to quantify such efforts. Therefore, in the future, companies could even be ranked according to their performance or progress in terms of ESG.

ESGs allow for a holistic view of the company’s activities and provide investors insight into the positive and negative externalities of making an investment. The social aspect is related to labour standards, supply chain standards, consumer protection, animal welfare, health and safety and human rights. The environmental facet is associated environmental policy, ecological footprint, resource use, pollution and general environmental sustainability matters. Finally, the corporate governance aspect is about corporate governance, corruption, employee and executive compensation, political lobbying, tax transparency, board independence and diversity.

Who does ESG apply to? Focusing on ESG is not solely for social enterprises or the non- profit sector, it is the future for all companies. Though releasing ESG reports may seem to be a risk for the reputation of firms involved in polluting activities, for instance, it is important to recognize that incorporating ESG are actually an opportunity to identify risks, measure progress and increase transparency. As consumers are increasingly conscious of what companies they support and investors increasingly care about the impact of their investments, ESGs are likely to become widespread tool inside, but also outside of investment circles.

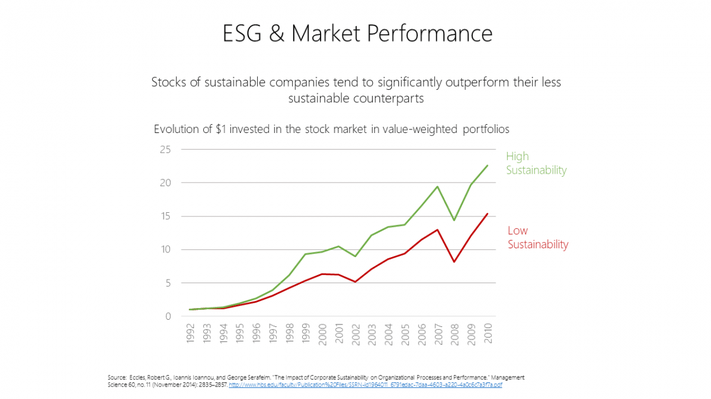

In fact, ESGs create value in several ways. They reduce costs, increase productivity and optimize investments. A focus on ESG can also improve reputation, attract new customers or earn government support. In addition, reporting ESGs is an opportunity for companies performing well to stand out to investors, no matter how small or newtheyare.

“Getting involved with ESG means your company can help set the standards for ESG in your industry”

In the years to come, reporting ESG will become the norm. Companies should join the movement towards ESG if they want to keep their reputation and investors. More importantly, getting involved with ESG, notably through The ESG Foundation, means your company can help set the standards for ESG in your industry, but also across sectors. By incorporating an ESG framework, your company can lead the transition into an era, which is likely to redefine our understanding of the purpose of companies and therefore, to restructure their functioning.

Overall, the emphasis on ESG is a step towards responsible and sustainable investing. Indeed, compared to CSR, which was targeted at consumers and the non- profit sector, ESGs audience is primarily investors and potential investors. ESG criteria helps investors assess the financial performance of a company in the future. Companies performing well by ESG criteria have been proven to grow fast.