ESG is no longer just a set of criteria for ethical investment decisions – it’s become an essential tool for risk management too, making it even more crucial for companies to learn how to report their ESG metrics in 2021.

What is ESG?

ESG is a framework that provides businesses with an opportunity to report their performance across a series of factors that are central to their corporate social responsibility. It encompasses three areas of focus – environmental, social and governance.

The introduction of ESG in the 1960s was a major turning point for the future of investment portfolios. Initially used by investors as a set of criteria for making ethical investment decisions, ESG has now evolved into a fundamental aspect of modern business models.

In order to perform well based on ESG metrics, a company should aim to:

1. Reduce their Environmental footprint

2. Promote Social fairness

3. Ensure Good Governance by leadership teams and stakeholders

Why is ESG reporting important for your company?

ESG metrics serve as an indicator of good practice and social responsibility, making it a valuable tool for providing stakeholders and future employees with an insight into the business’s ethos. More recently, it has become evident that ESG reporting can also be hugely beneficial to a business as a tool in risk management. MSCI data shows that businesses with lower ESG scores have been more likely to suffer a catastrophic loss within three years (MSCI, 2017).

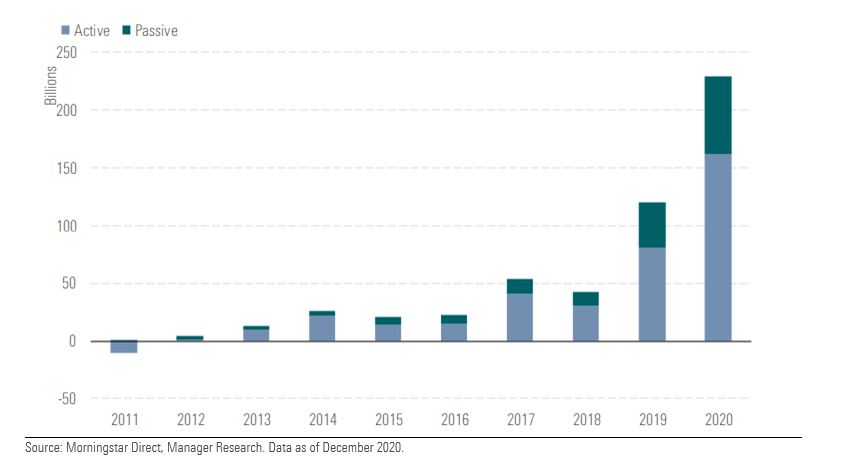

Social responsibility has become an increasingly significant factor in the financial performance of investment portfolios over the last few decades. According to research conducted by the financial analytics company Morningstar, institutional and retail investments into sustainable businesses in Europe are currently at a record high, which confirms the financial benefits of transparent ESG reporting.

How is the ESG Foundation supporting companies with ESG reporting?

The ESG Foundation aims to shed light on good ESG reporting practices and to encourage companies to incorporate these metrics into their performance reports. We have a dedicated support page for companies who’d like to seek guidance from us on ESG reporting and want to learn how they can implement this into their performance reports. We also showcase ESG reports from a range of industries showing good practice – so if you’re new to ESG reporting, we recommend starting here. You’ll notice from our showcase that there isn’t just one way to write an ESG report – in fact, consistency across the guidelines for ESG scoring is something that investors and sustainability analysts are currently advocating for. With a growing awareness of the importance of ESG reporting across all business sectors, we hope to set the bar for the standard of future ESG reporting with the support of our ambassadors.

We’ll be inviting companies who show evidence of good ESG reporting practice to share their insights at an annual awards ceremony during our official launch in July 2021, You can follow us for updates here.

Further reading: