Environmental, Social and Governance, or “ESG” risks are amongst the most topical and widely discussed within any organization’s risk profile currently. A significant focus has been placed by governments and regulators on climate change risk, but the scope of ESG risks faced by most organizations are much broader and more complex than that.

How do these ESG risks differ from any other enterprise risks? They have several interesting facets:

- The perception of the risk issues may vary significantly for different stakeholders

- Shareholders and Non-Governmental Organizations (“NGOs”) may perceive new products in quite different ways

- The nature of the risks are changing quite rapidly with time

- #metoo was a game-changer in terms of acceptable behavior in the media industries

- The risks impact primarily on the reputation of organizations

- In a world of 24 hour news and social media, the reaction time for many organizations’ crisis management communication is significantly reduced

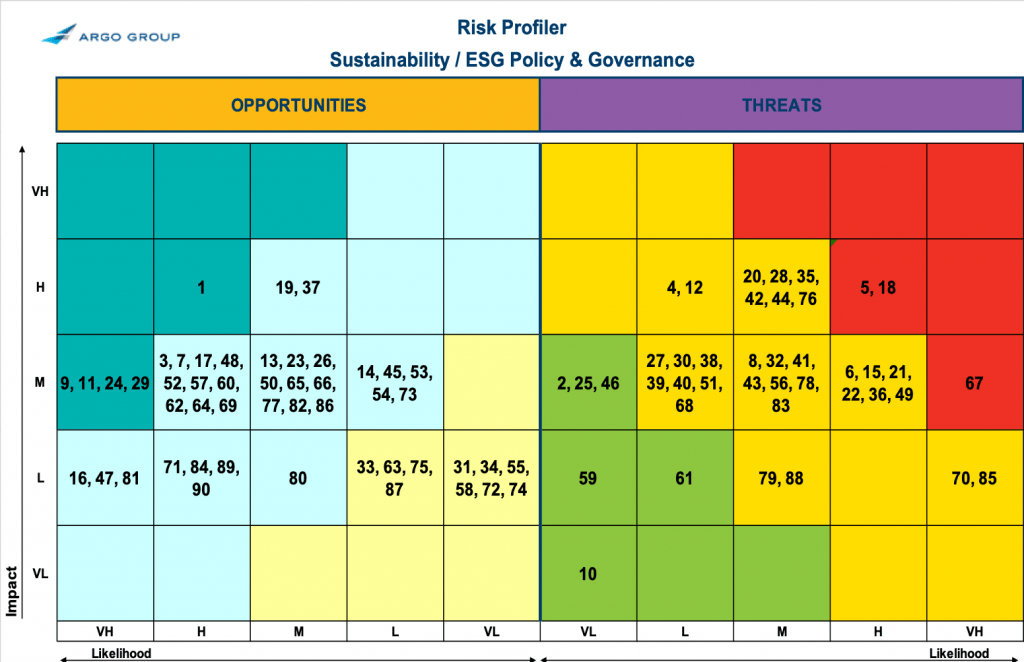

It is particularly helpful therefore to consider both threats and opportunities when considering the ESG landscape and to understand how these are perceived by a range of stakeholders. It is not unusual for threat to be perceived negatively by the majority of stakeholders, but be seen as an opportunity for one stakeholder group.

At Argo Group our approach has been to build up a threat and opportunity assessment over time, using subject-matter experts across the company, in particularly our Sustainability Working Group to inform our assessment of a range of risks as they change over time.

The main benefit of applying risk management to such an assessment, is the way it facilitates prioritization.

Alex Hindson is Chief Risk & Sustainability Officer at Argo Group and co-chair of the Risk Officer Sustainability Forum (https://www.riskcoalition.org.uk/rosf)